maricopa county tax lien map

The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy and accountability of their tax dollars. 2223 16th of 50 364 13th of 50 135 13th of 50.

Arizona County Map County Map Arizona Maricopa County

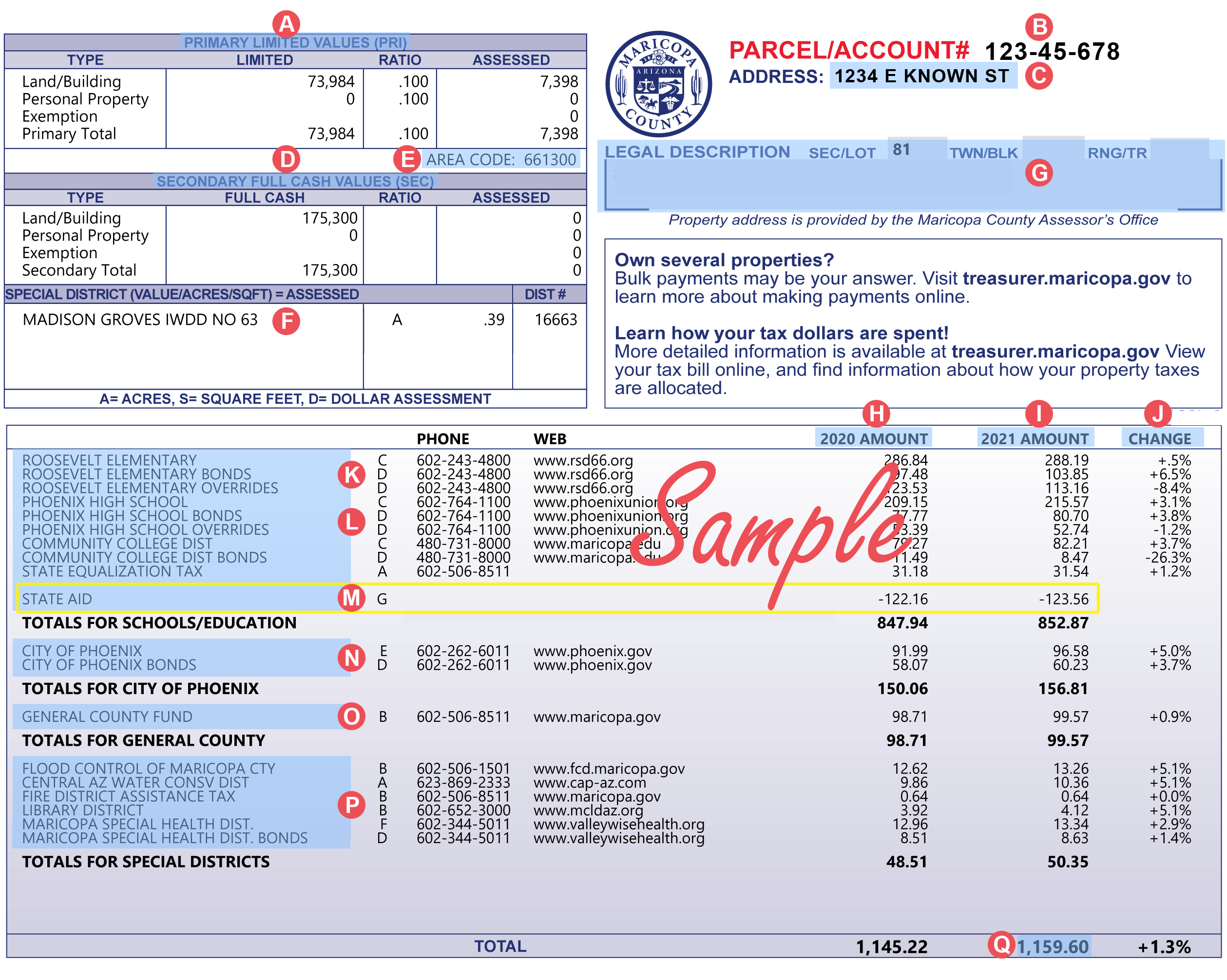

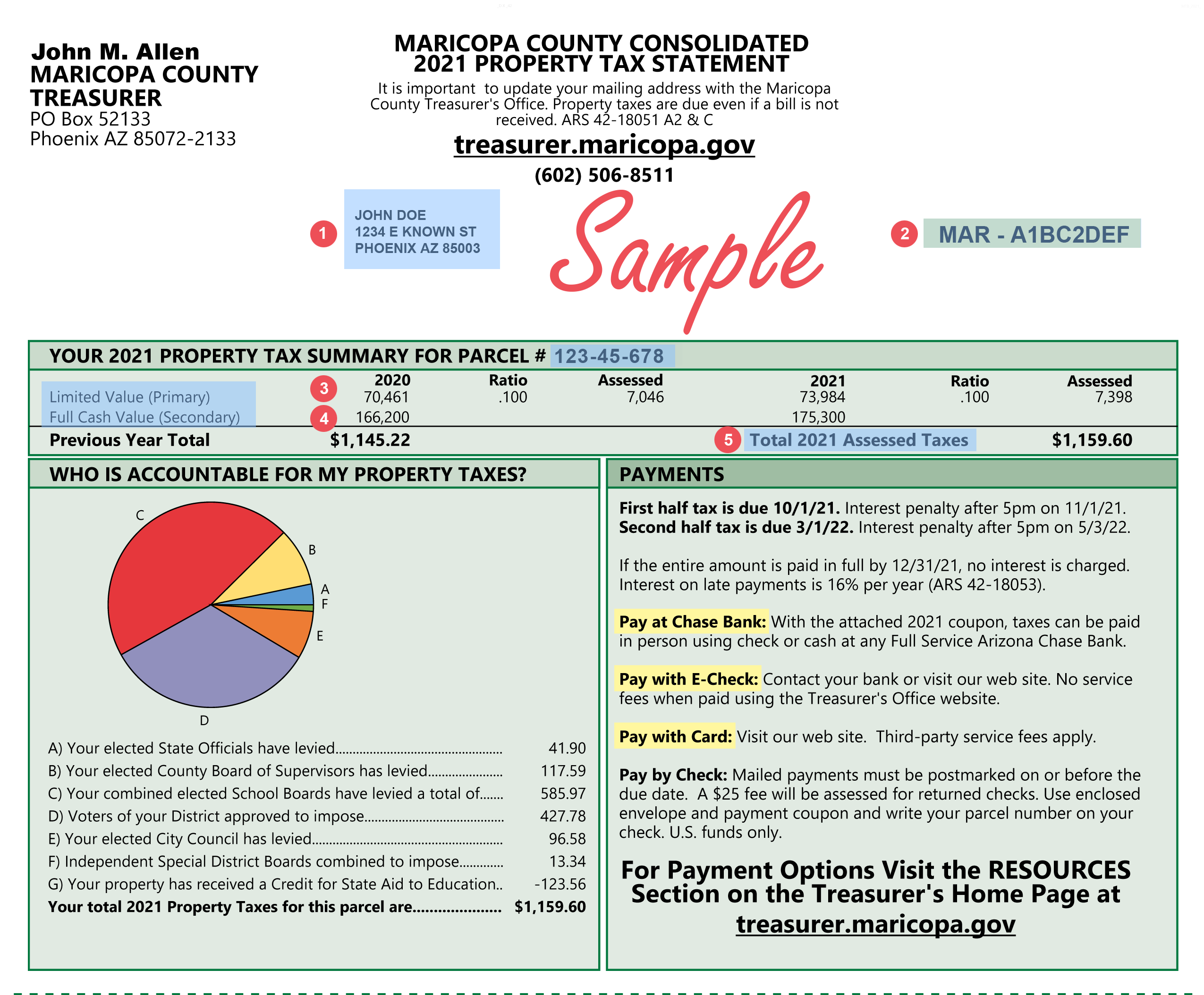

February 2023 - Assessor mails 2024 Notices of Value.

. For example California requires a Claim of Lien form as well as a notice and an affidavit. The purpose of the Recorder of Deeds is to ensure the accuracy of Maricopa County property and land records and to preserve their continuity. After a municipality issues a tax lien.

The median property tax in Maricopa County Arizona is 1418 per year for a home worth the median value of 238600. He was elected in November 2020 and took office January 2021. South Carolina has one of the lowest median property tax rates in the United States with only five states collecting a lower median property tax than South Carolina.

Assessor Graham County Assessor General Services Building 921 Thatcher Blvd Safford AZ 85546 Phone 928428-2828 Fax 928428-5849. Tax liens for sale. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a.

The median property tax in Hamilton County Tennessee is 1270 per year for a home worth the median value of 147200. February 15 2023 - RealAuction Internet Back Tax Lien Sale for 2022 taxes. Maricopa County collects on average 059 of a propertys assessed fair market value as property tax.

Auction properties are updated daily on Parcel Fair to remove redeemed properties. Hamilton County collects on average 086 of a propertys assessed fair market value as property tax. 1996 Senior Lien Series A and Junior Lien Series B November 21 2017.

LaSalle County collects on average 21 of a propertys assessed fair market value as property tax. View Jefferson-Bessemer Tax Auction Map View Jefferson-Birmingham Tax Auction Map. Property ownership and transfers.

Maricopa County 11529 Pima County 6529 Pinal County 4043 View more. For more localized statistics you can find your county in the Pennsylvania property tax map or county list found on this page. Aka map book page and parcel that identifies each piece of real property for property tax purposes eg 1234-567-890.

South Carolinas median income is 52001 per year so the median yearly property. Property owners may contact the Register of Deeds for questions about. The median property tax in Ellis County Texas is 2501 per year for a home worth the median value of 136100.

Coconino Maricopa Mohave Navajo Pima Pinal and Yavapai 2022 tax auctions. LaSalle County has one of the highest median property taxes in the United States and is ranked 246th of the 3143 counties in order of median property taxes. Please call ahead for an appointment at 480-644-2335.

The median property tax in LaSalle County Illinois is 2632 per year for a home worth the median value of 125500. Yavapai County Property Records are real estate documents that contain information related to real property in Yavapai County Arizona. Delinquent and Unsold Parcels.

Fairfax County has one of the highest median property taxes in the United States and is ranked 41st of the 3143 counties in order of median property taxes. Pima County Property Records are real estate documents that contain information related to real property in Pima County Arizona. Arizona is ranked 874th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Ellis County has one of the highest median property taxes in the United States and is ranked 280th of the 3143 counties in order of median property taxes. Percentage Of Property Value. BOX 54018 LOS ANGELES CA 90054-0018.

Tennessee is ranked 1062nd of the 3143 counties in the United States in order of the median amount of property taxes collected. Maricopa County Treasurers Office John M. Please mail completed forms to Maricopa County Treasurer 301 W Jefferson St 140 Phoenix AZ 85003 or fax to 602 506-1102.

California 1 Riverside County 1. Charleston County collects on average 05 of a propertys assessed fair market value as property tax. Ellis County collects on average 184 of a propertys assessed fair market value as property tax.

He was elected in November 2020 and took office January 2021. Maricopa County property records. Rental price 70 per night.

Draw up your lien. LOS ANGELES COUNTY TAX COLLECTOR PO. Fairfax County collects on average 089 of a propertys assessed fair market value as property tax.

2022 County Tax Lien Auctions. A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt. A lien typically is a one-page document with information about the creditor the debtor and the property.

A number will be assigned to each bidder for use when purchasing tax liens through the Treasurers office and the online Tax Lien Sale. South Carolina is ranked 1168th of the 3143 counties in the United States in order of the median amount of property taxes collected. Search Graham County property tax and assessment records by parcel number book and map address owner name or tax ID.

A member of the Federal Bureau of Investigation Desert Hawk Violent Crimes Task Force is launching Maricopa Countys Most Wanted to locate and apprehend violent fugitives wanted on arrest warrants or probable cause. Stephen Richer is the 30th Recorder of Maricopa County. Deed and title searches in Maricopa County Arizona.

GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. The median property tax in South Carolina is 68900 per year05 of a propertys assesed fair market value as property tax per year. Maricopa County Treasurers Home Page.

MELLO-ROOS AND COUNTY IMPROVEMENT DISTRICTS. Most states have specific court forms to fill out. The median property tax in Charleston County South Carolina is 1205 per year for a home worth the median value of 242100.

The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800. Prior to his election as Recorder Stephen worked as a lawyer and business person. Established in 1891 the Mesa Cemetery has served our community with dedication and distinction for more than a century.

Public Property Records provide information on homes land or commercial properties including titles mortgages property.

Land Brokers Phoenix Arizona Land For Sale

Displaced In America Housing Loss In Maricopa County Arizona

City Limits Maricopa County Az

Amazon Com Maricopa County Arizona Zip Codes 48 X 36 Matte Plastic Wall Map Office Products

Amazon Com Maricopa County Arizona Zip Codes 48 X 36 Matte Plastic Wall Map Office Products

Maricopa County Zip Code Map Area Rate Map Zip Code Map Metro Map Map

B Land Use Element Maricopa Az

County Officials Educate Public On How Precinct Lines Are Drawn The Daily Independent At Yourvalley Net

Maricopa County Island What Is It Arizona Homes Horse Property

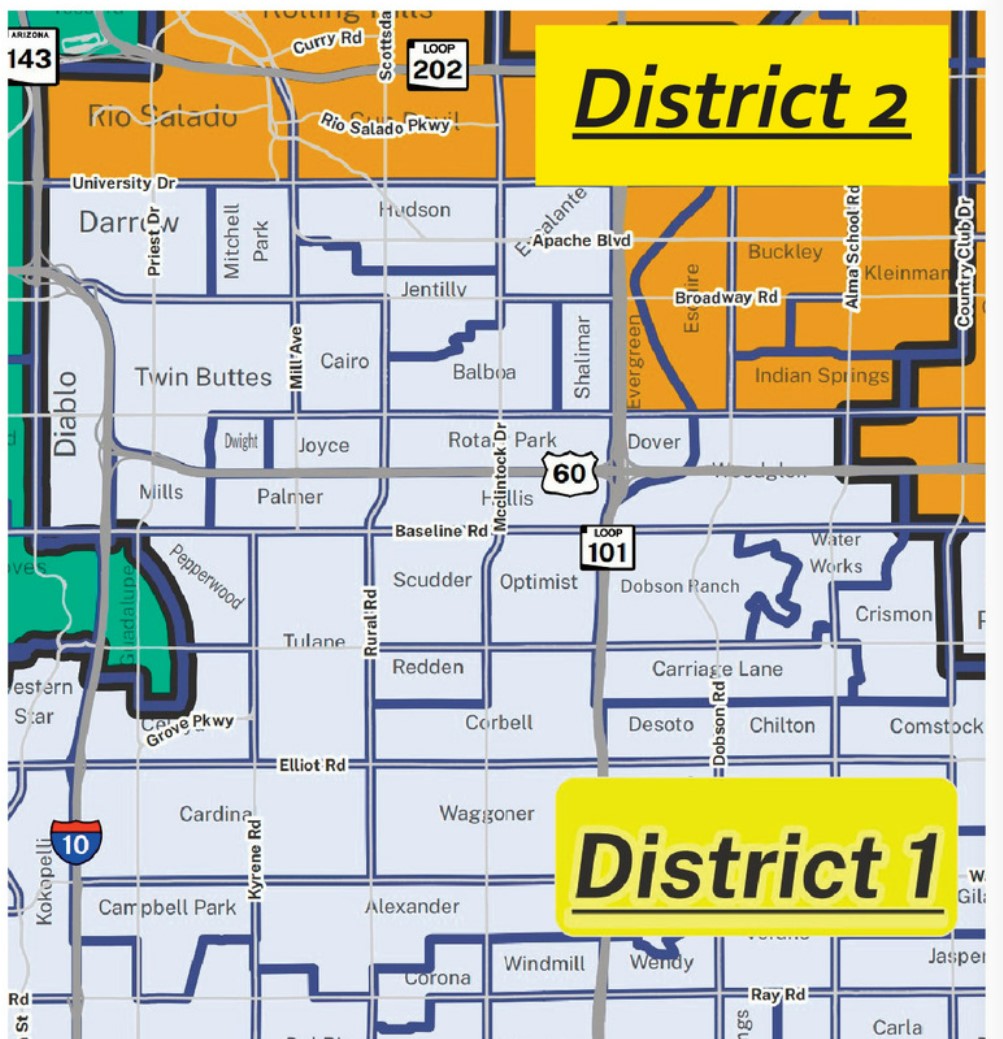

Uncertainty Rises As Maricopa County Supervisors Split Tempe Into 2 Districts Wrangler News

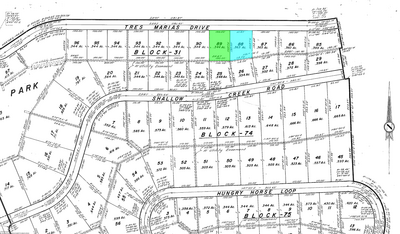

2017 Maricopa County Parcel Data Asu Library

Amazon Com Maricopa County Arizona 48 X 36 Paper Wall Map Home Kitchen

City Limits Maricopa County Az

Amazon Com Maricopa County Arizona 48 X 36 Paper Wall Map Home Kitchen

New Supervisor Districts Ok D Maricopa Whole Coolidge Split News Pinalcentral Com